An app designed for everyday spending and tomorrow's savings

A full-service account.

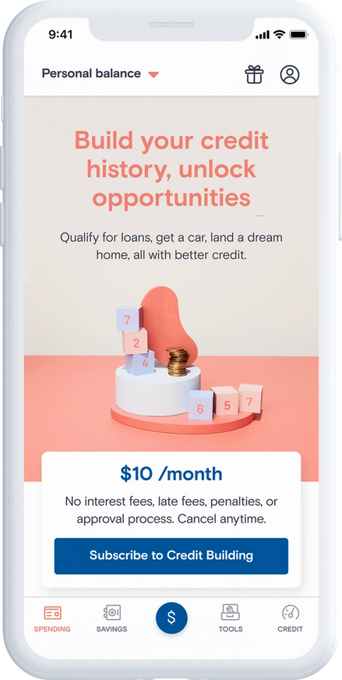

Get $20 when you sign up for a KOHO account with code MANZILKOHO and make your first purchase! Plus, get 3-months of KOHO Credit Building for free*

AAOIFI compliant, 100% halal

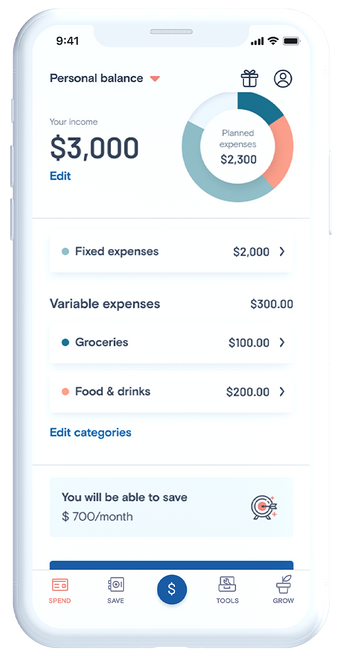

Your money, managed your way

Build your credit history

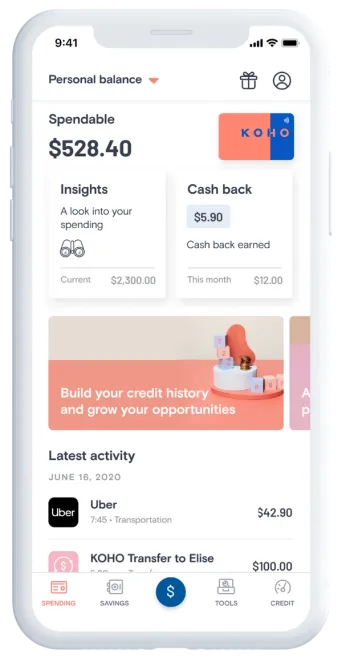

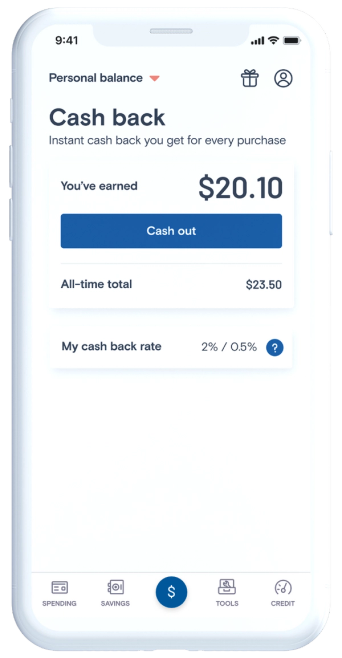

Instant cash back

Extra

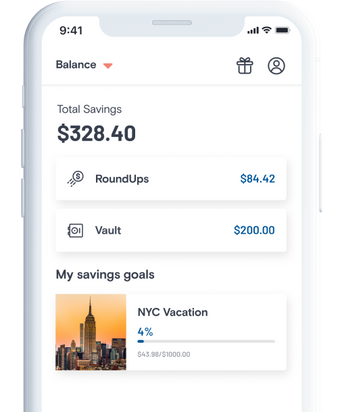

Save and Earn

FAQS

KOHO is a spending and savings account where you can get instant cashback and earn interest on your entire account. You get a prepaid reloadable credit card that gives you all the spending power of a credit card without any interest.

Unlike a credit card, however, the KOHO card draws from funds that are already your money. This key difference makes could help you spend more mindfully. It’s connected to a smart budgeting app that simplifies day-to-day finances with spending insights and you can sign up to receive balance updates after each purchase.

It’s pretty simple. You add funds to your KOHO account in one of three ways: setting up a direct deposit, e-Transfer from your regular bank account, or loading through an existing debit card.

You can then use your KOHO card, either in person or online, to make purchases just like you would with any debit or credit. Even more impressively, your new KOHO card supports Apple Pay, Google Pay, and Samsung Pay – it’s one of the only cards available that supports all three of those payment platforms. If your cellphone is NFC-capable you can tap away or just use your physical KOHO card to complete a transaction. Talk about convenience!

The big difference is that we’re digital-first. We prioritize financially empowering our users. For example, we do not charge any fee for ATM Withdrawals+. Consequently, we can keep our costs low and aim to pass these savings to our users.

Plus, you get unlimited cashback on all your purchases and 5% interest on your account balance. You can make even more when you shop at our brand partners.

The bottom line? You can earn money just for buying the things you were going to buy anyway, but without the stress and risk of going into credit card debt.

Also, our app is pretty awesome.

For most of us, KOHO is the perfect solution. And if you’re okay with having your paycheque deposited directly and you never need to write a paper cheque (and let’s be honest, very few people write paper cheques any more, not in a world of Interac payments and PayPal), you could technically use KOHO for all your chequing account needs and ditch the expensive Big 5 Bank chequing account for good. Why pay $15 or more per month for a paper-based chequing account when you can get KOHO Essential at no fees?

And with KOHO (unlike those other institutions) there are no NSF fees if you run into some difficulty with a transaction, lower foreign transaction fees than the Big Five banks charge (1.5% with KOHO versus 3.5% with the big banks), free and unlimited e-Transfers and even access to your money from any ATM. KOHO is everything you should need in a bank account, plus a whole lot of exciting additional tools.