An app designed for everyday spending and tomorrow's savings

- KOHO is a full-service app and reloadable prepaid credit card with no hidden fees.

- Get $20 when you sign up for a free KOHO account with code KOHOHISA20 and make your first purchase! Plus, enjoy 3 months of KOHO Extra*

Your money, managed your way

KOHO is a free chequing account that acts like a debit card but gives you all the spending power of a credit card without the interest or fees.

Your app and physical prepaid credit card work together to make day-to-day finances smart and stress-free. With cash back and no fees, KOHO users can save more and pay down debt quicker. Get balance updates after each purchase. With KOHO, you can see how you are tracking each day, week, or month with our spending insights.

Earn high interest

Boost your savings!

With your free KOHO account, you can earn up to 4.5% interest** on both your spending and savings account.

No minimum balance required. No delays and no need to make an appointment. Your funds are securely held with a variety of financial institutions, and all interest-bearing deposits are eligible for CDIC protection.

Check out how to set up direct deposit with KOHO.

Extra

Unlock all the perks by being a KOHO Extra member!

Earn higher cash back and saving interest. Enjoy $0 FX fees on all international transactions. Plus, one free international ATM withdrawal per month. Priority user support.

You can work anywhere at ease and have no need to worry about your finance.

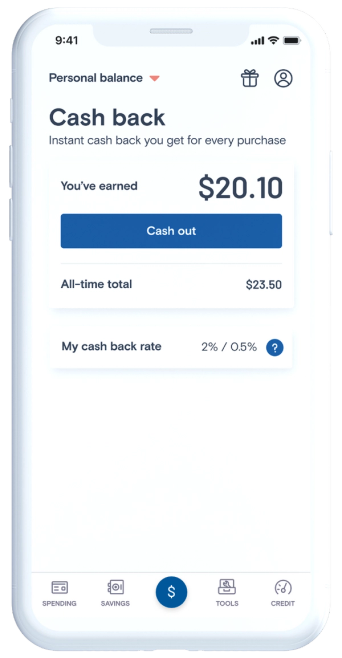

Instant cashback

KOHO is the only account with truly no monthly fees, no interest charges, no e-Transfer fees, and no NSF fees.

Get unlimited cash back! You can earn up to an extra 6% cashback at select merchants.

With KOHO Extra, you get unlimited instant cash back from all purchases. 2% on Groceries, Eating & Drinking, and Transportation. 0.5% cash back on other categories.

Save and Earn

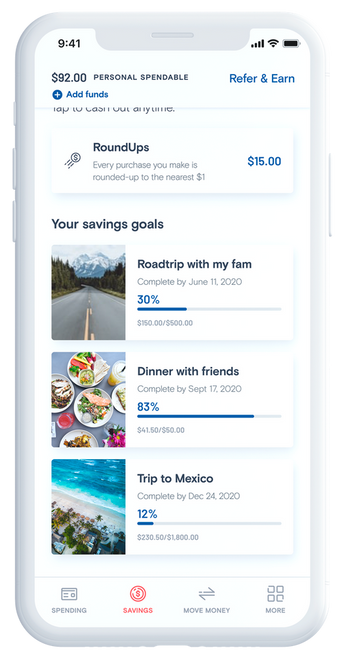

Have our app RoundUp your spare change and stash it away! Reach your goals faster with automated savings. Lock your card in-app, securely shop online, and rest assured your money is protected with top-tier security. It’s no wonder why KOHO is trusted by over a million Canadians.

Budgeting and Planning

Automate your savings goals and bill payments whether it’s small expenses or your future savings. We’ve also made it easier to help you save as you spend by allowing you to choose to round up purchases to the nearest $1, $2, $5, or $10. You can also get balance updates after each purchase and spending insights to help you to stay on track.

Get StartedOpen AccountQuestions

KOHO is a spending and savings account where you can get instant cashback and earn interest on your entire account. You get a prepaid reloadable credit card that gives you all the spending power of a credit card without any interest.

Unlike a credit card, however, the KOHO card draws from funds that are already your money. This key difference makes could help you spend more mindfully. It’s connected to a smart budgeting app that simplifies day-to-day finances with spending insights and you can sign up to receive balance updates after each purchase.

It’s pretty simple. You add funds to your KOHO account in one of three ways: setting up a direct deposit, e-Transfer from your regular bank account, or loading through an existing debit card.

You can then use your KOHO card, either in person or online, to make purchases just like you would with any debit or credit. Even more impressively, your new KOHO card supports Apple Pay, Google Pay, and Samsung Pay – it’s one of the only cards available that supports all three of those payment platforms. If your cellphone is NFC-capable you can tap away or just use your physical KOHO card to complete a transaction. Talk about convenience!

The big difference is that we’re digital-first. We prioritize financially empowering our users. For example, we do not charge any fee for ATM Withdrawals+. Consequently, we can keep our costs low and aim to pass these savings to our users.

Plus, you get unlimited cashback on all your purchases and 5% interest on your account balance. You can make even more when you shop at our brand partners.

The bottom line? You can earn money just for buying the things you were going to buy anyway, but without the stress and risk of going into credit card debt.

Also, our app is pretty awesome.

For most of us, KOHO is the perfect solution. And if you’re okay with having your paycheque deposited directly and you never need to write a paper cheque (and let’s be honest, very few people write paper cheques any more, not in a world of Interac payments and PayPal), you could technically use KOHO for all your chequing account needs and ditch the expensive Big 5 Bank chequing account for good. Why pay $15 or more per month for a paper-based chequing account when you can get KOHO Essential at no fees?

And with KOHO (unlike those other institutions) there are no NSF fees if you run into some difficulty with a transaction, lower foreign transaction fees than the Big Five banks charge (1.5% with KOHO versus 3.5% with the big banks), free and unlimited e-Transfers and even access to your money from any ATM. KOHO is everything you should need in a bank account, plus a whole lot of exciting additional tools.